There are critical connotations concerning systemic risk that puts into evidence the existing vacuum on financial monitoring and regulation and its failure to move and evolve at the pace of financial innovation. Besides, there is a significant lack of understanding concerning the risks associated with the growing dimensions of the Fintech sector.

There seems to be a general belief that Fintech is a new and groundbreaking trend when the reality is quite different, as we are facing an evolution of a long-existing relationship. The buzzing word Fintech has been introduced to link finance and technology, appearing as if we are facing a revolution in the field. However, there is little awareness of finance and technology's historical connections. Technology, innovation, and finance share a long historical relationship, with technology and innovation playing a crucial role in developing the global financial system. Nevertheless, technology is not new to finance, and it has been there for quite a while.

Introduction Nowadays, the connection between finance and technology is a trendy and hot topic (Omarava, 2019). The results were surprising as the FinTech sector's speed of development and the fast changes in innovation lead to significant risks that do not seem to be captured by the examined market and firm-specific data sets. The main findings revealed a lack of significant differences between the FinTech and Non-FinTech firms in the US stock market.

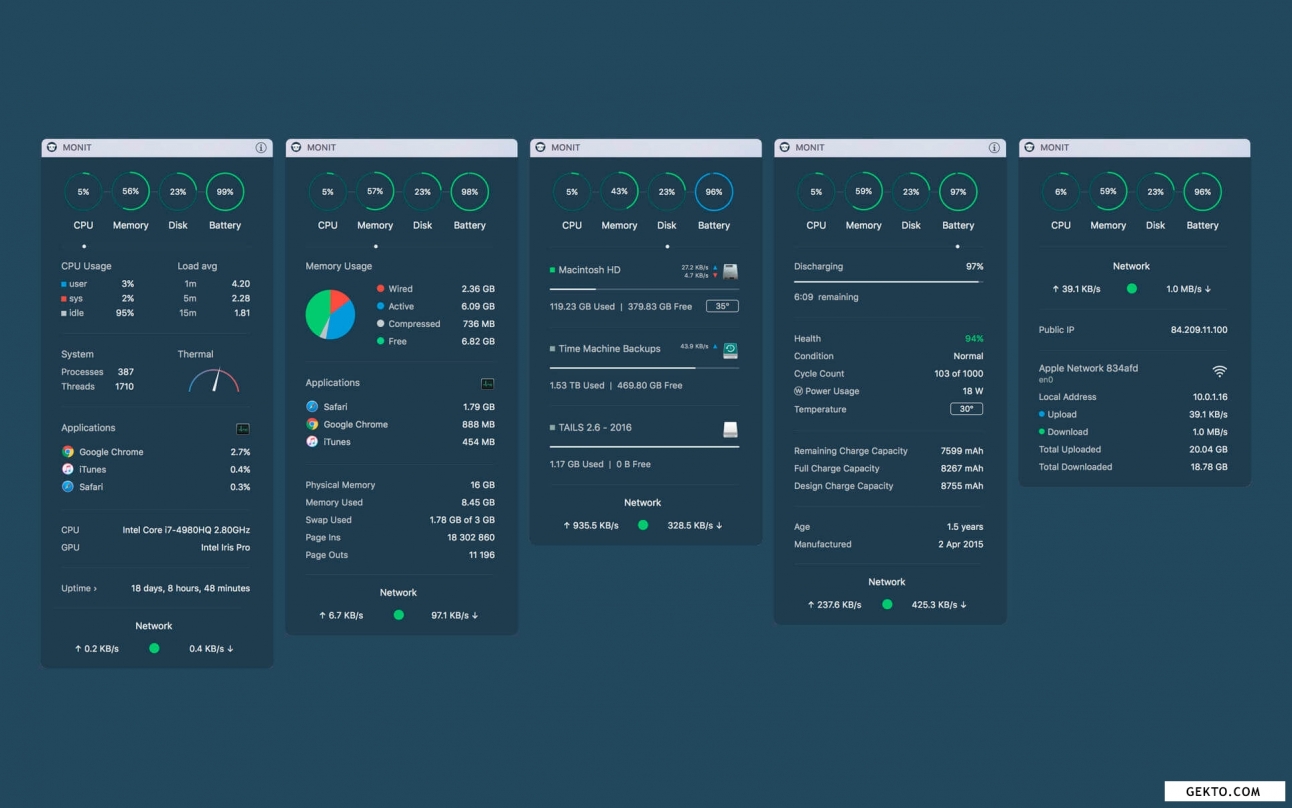

#Monit fintech series#

To examine the risk profile of FinTech firms, the CRISP-DM methodology was followed to aid in the implementation of clustering and classification algorithms, combined with time series regression models. The FinTech industry has exhibited very high growth levels that have been accelerated because of the disruption caused by COVID-19.

0 kommentar(er)

0 kommentar(er)